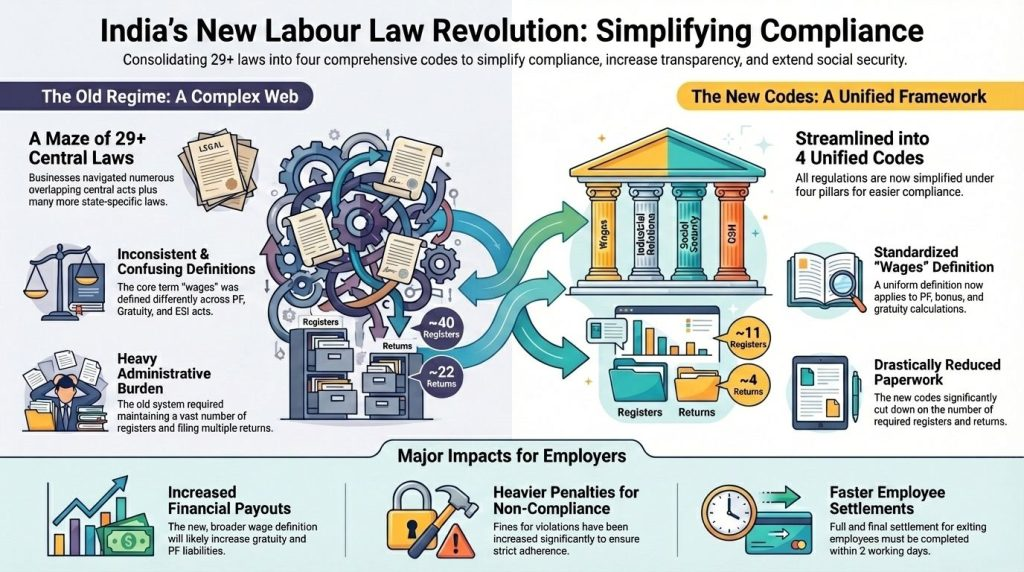

New Delhi – On November 21, 2025, India implemented a sweeping overhaul of its labour laws – consolidating 29 outdated statutes into four unified Labour Codes covering wages, social security, industrial relations, and workplace safety. The reforms are being hailed as the largest shake-up of workforce regulation in decades, and carry major implications for millions of salaried and gig-economy workers.

Major Changes Under the New Codes

- Basic pay must be > 50% of CTC: The new Wage Code mandates that the “basic salary + dearness or retaining allowances” must make up at least 50% of total Cost-to-Company (CTC), replacing the old structure where allowances often formed the bulk of pay. Source: The Economic Times

- PF, gratuity & social-security benefits increase: Because statutory benefits like Provident Fund (PF), gratuity, pension, and leave encashment are calculated on basic pay, increasing the basic component automatically boosts long-term savings and benefits. Source: legalaims.com

- Contract/fixed-term employees get gratuity after 1 year: Under old laws, employees needed 5 years before qualifying for gratuity; the new code reduces this to just one year – a major win for contractual workers. Source: The Economic Times

- Gig & platform workers get coverage: For the first time, gig-economy and platform workers are formally covered under social security benefits – including PF, health coverage, and pension protections. Source: India Today

- More rights for women, safer working conditions, standardization: The codes mandate equal pay – including for night shifts (with consent and protections) – mandatory appointment letters, annual health check-ups for certain workers, and better regulation of overtime, leave, and safety standards. Source: The Economic Times

Short-Term Impact vs Long-Term Benefits

For employees under CTC bands of 15 lakh-25 lakh per year:

- Take-home pay may dip slightly, because higher PF and gratuity deductions reduce monthly in-hand salary.

- Long-term benefits increase significantly, thanks to larger retirement savings, better pension/gratuity, enhanced social security, and coverage for previously unprotected workers such as gig/contract labour.

Employers will need to revise salary structures, allowances, bonus policies, and compliance frameworks. Spending on statutory benefits and payroll overhead is set to increase – but the increased social security and formalization could stabilize the labour market and increase worker retention.

Why the Reform Matters Now

India is undergoing rapid industrial growth, digitization, and expansion of new sectors like gig-economy, remote work, and platform-based services. The prior patchwork of outdated laws was insufficient for the modern economy.

These new codes:

- Provide legal cover and protections to millions previously working without formal contracts or benefits

- Ensure fair wages and prevent exploitation by banning inflated allowances meant to dodge PF/gratuity liabilities

- Bring transparency and standardization across industries and employment types

- Reduce long-term inequality by securing retirement savings and social security for all workers

“Under the 2025 Labour Code, every fixed-term and gig worker now gets a social safety net – it’s not just a change of law, but a change in dignity of work.” – labour-policy analysts quoted by legal review journals.

In effect, the new labour codes represent a major structural upgrade to India’s workforce regulations – a modernization aligned with global standards, social justice, and economic competitiveness.